×

Please verify

Each day we overwhelm your brains with the content you've come to love from the Louder with Crowder Dot Com website.

But Facebook is...you know, Facebook. Their algorithm hides our ranting and raving as best it can. The best way to stick it to Zuckerface?

Sign up for the LWC News Blast! Get your favorite right-wing commentary delivered directly to your inbox!

ArticlesApril 30, 2024

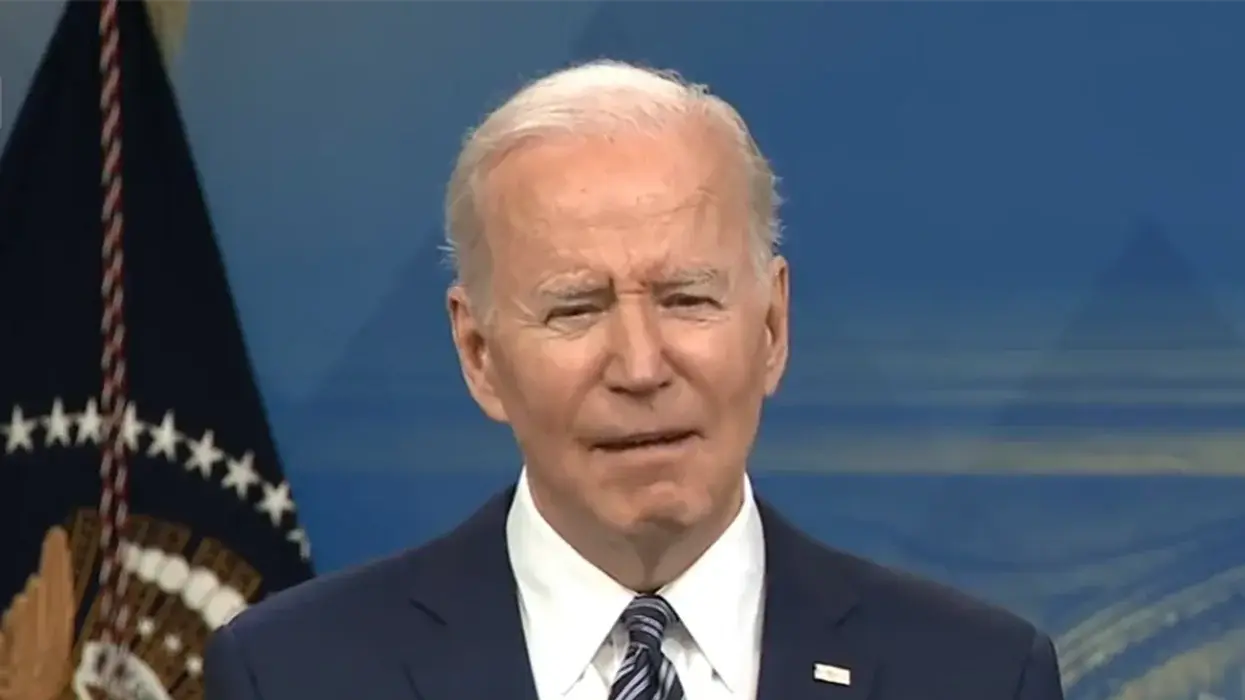

Biden Admin Mulls "Racial Inequality Tax" That Would Negatively Affect, Of Course, More White People

Watch Louder with Crowder every weekday at 11:00 AM Eastern, only on Rumble Premium!

Nearly 76 percent of the population is White. So by raising taxes on the majority of the population, Biden feels we might finally fix racism once and for all. And if he wins the presidential election and does raise taxes on White people, this better be the end all that will do it because there is only so much we can do to fix the invisible evil known as systemic racism.

According to the Daily Caller:

The Biden administration’s analysis of its revenue proposals for fiscal year 2025 argues targeted tax hikes that disproportionately affect white people would ease racial wealth inequality.

Increasing taxes on capital gains and income-based wealth would reduce racial wealth inequality for black and Hispanic families, the Treasury Department outlined in the analysis published in mid-March. The Treasury points out that white families disproportionately hold assets subject to capital gains tax or are in a higher tax bracket, meaning a hike in those taxes would benefit black and Hispanic families.

Question: How would making white people poorer do anything to make minorities richer? If Biden's goal is to totally destroy the middle class, this is definitely the way to do it. As it turns out, the goal is not to help anyone and it's actually intended to make everyone worse off.

The Biden administration argues for taxing capital income for high-income earners at “ordinary rates,” increasing the top rate from 37% to 39.6% for those who earn more than $1 million a year. Taxes on net investment income would also be hiked by 1.2 percentage points to 5% for those who make over $400,000 per year, bringing the total top marginal rate to 44.6%.

If your goal is to fuel the economy, I don't think discouraging investments will help with that.

“Taxing capital gains at 44.6% at the federal level — not to mention state taxes — would be economic suicide,” Preston Brashers, research fellow for tax policy in the Heritage Foundation’s Grover M. Hermann Center for the Federal Budget, told the Daily Caller News Foundation. “Before the tax ever took effect, investors would rush to pull their money out of equities subject to such exorbitant tax rates. U.S. businesses would be starved for capital, and business activity would slow to a crawl. Ultimately, corporate income and capital gains income would fall off a cliff, so the net result would be less tax revenue, not more. The middle class and working class would be slammed with mass layoffs and lower real wages.”

The Treasury estimates that white families are the recipients of 92% of the benefits of preferential rates on capital gains and qualified dividends, compared to 2% and 3% for Hispanic families. Only 0.4% of white families, less than 0.05% of black families and 0.1% of Hispanic families will be affected by the proposed rule change on capital gains.

There are only two reasons someone would do this. One, because they are mentally incompetent and think that this will somehow fuel the economy. Or two, they want to make everyone worse off.

There is no way the government will be able to more efficiently spend that money than the people who earned it. There has never been a case where bureaucracy has been more effective at something than the private sector.

What's irritating about the government raising taxes, no matter how much it is, is that they demand more of our money as if they are somehow entitled to the fruits of our labor. And we get nothing out of it while the government is never held accountable if they do not hold up their end of the bargain.

And how is it fair that someone must pay more into a system that they are less likely to use? Insurance does not charge more based on income so why does the government get to hold such a progressive tax system?

The Biden administration is also proposing to expand the child tax credit, temporarily increasing the amount given per child and permanently restoring the full refundability provision. The Treasury argues that it will ease racial disparities since a disproportionate number of black and Hispanic kids have benefited from it in the past.

“These proposals would also increase the fairness of the tax system by addressing some of the features that have historically reinforced racial disparities,” the proposal reads. “Over time, these proposals are expected to increase wealth accumulation by low- and middle-income families and reduce racial wealth gaps.”

Never in the history of anything has welfare increased wealth.

Question: When has redistribution ever helped anyone become richer except the government? Because I am having trouble finding that answer in my History of Communism textbook.

On top of all that, if Biden wins a second term, he plans to increase the debt by $14.8 trillion.

The left is never satisfied, how much more money does the rich have to fork over before they finally pay their "fair share." And none of that is fair since the rich take none of the shares. It's even more foolish considering that the government is implying it's not fair that they have more money than other people, especially considering their policies are so anti-middle class it's not even funny. But none of that makes sense and is just a bunch of Socialist gobbledegook.

INDOCTRINATION TAX: How Your Property Taxes Are Funding a Woke Curriculumwww.youtube.com

Latest